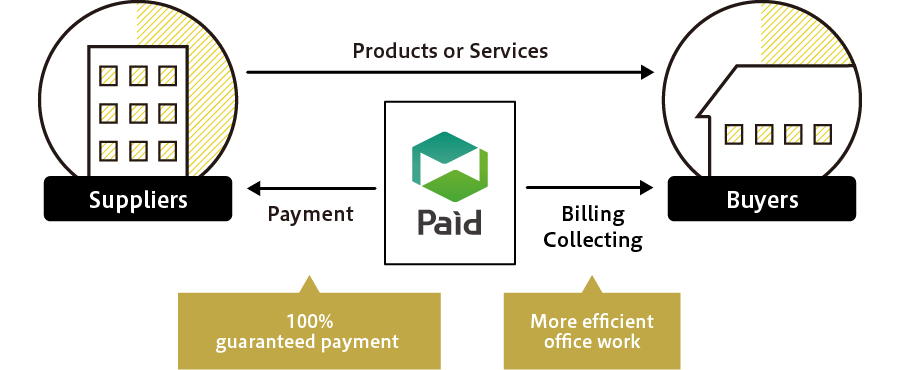

A Deferred payment service between enterprises that can eliminate the time and energy used to collect bills and the risk of uncollected bills.

"Credit sales" is the payment method commonly used in business-to-business transactions. In this method, suppliers deliver products first, and buyers make payments later.

Credit sales is common because in one hand, billing per month helps buyers with easier cash flow, compared to immediate payment. So this can lead to large orders. In the other hand, suppliers can reduce operating costs of accounting because they only need to issue bills at the end of the month and check payment at once, no matter the number of the teansactions occured within the month.

However, to avoid risks of unpaid in credit sales, suppliers need to make buyers' credit examinations in advance. In case of incompleted payments, suppliers need to redemand for payment. So even if buyers want to use credit sales in their transactions, it can be difficult since it takes a lot of costs and risks.

Paid acts as suppliers' agent in all operations, from the credit management to the collection of bills. Plus, Paid will pay to suppliers 100% of the payment also in case of unsuccessful collection of bills.